BML Launches Green Resort Financing to Support Sustainable Tourism

Business

BusinessAhmed Shurau

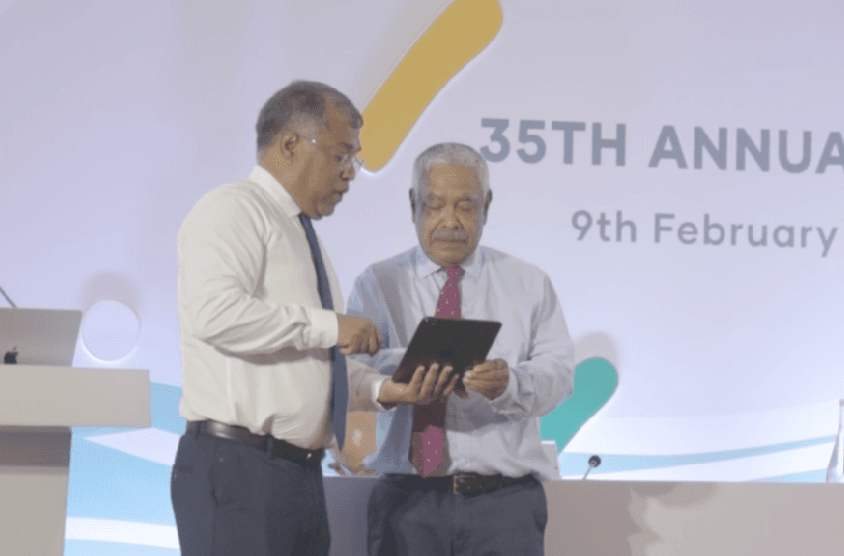

The Bank of Maldives (BML) has introduced Green Resort Financing, a new facility designed to support resorts in implementing sustainable business practices. The financing initiative was officially launched during the Maldives Association of Tourism Industry (MATI) Annual General Meeting today, with Chairman of Crown and Champa Resorts, Hussain Afeef, joining BML’s CEO and Managing Director, Mohamed Shareef, for the announcement.

The Green Resort Financing facility provides funding for key sustainability initiatives, including coastal protection, adoption of energy-efficient equipment, reforestation, and waste management.

Key Features of Green Resort Financing:

- Overdraft facility of up to MVR 50 million

- Competitive interest rate of 6.5% per annum

- Flexible repayments through card collections

Speaking at the launch, CEO Mohamed Shareef reaffirmed the Bank’s commitment to the tourism sector, stating, “As the largest and leading bank in the country, we are here to support our tourism industry with tailored banking and payment solutions. The Green Resort Finance facility is designed to provide resorts with the financial flexibility needed to implement sustainable solutions while ensuring operational efficiency.”

Corporate customers interested in Green Resort Financing are encouraged to reach out to their dedicated Relationship Manager for more information.

Sports12/16/20252nd Masters Athletics Championship Maldives 2026 Open for Registration

Sports12/16/20252nd Masters Athletics Championship Maldives 2026 Open for Registration News12/15/2025Customs Seize MVR 2.4 Million Worth of Cannabis at VIA

News12/15/2025Customs Seize MVR 2.4 Million Worth of Cannabis at VIA Business12/15/2025Ooredoo Maldives Launches New Roaming Data Add Ons for Travelers

Business12/15/2025Ooredoo Maldives Launches New Roaming Data Add Ons for Travelers.jpg&w=3840&q=75) News12/15/2025PG Office Files Charges Against 10 in Major Cigarette Theft Case

News12/15/2025PG Office Files Charges Against 10 in Major Cigarette Theft Case